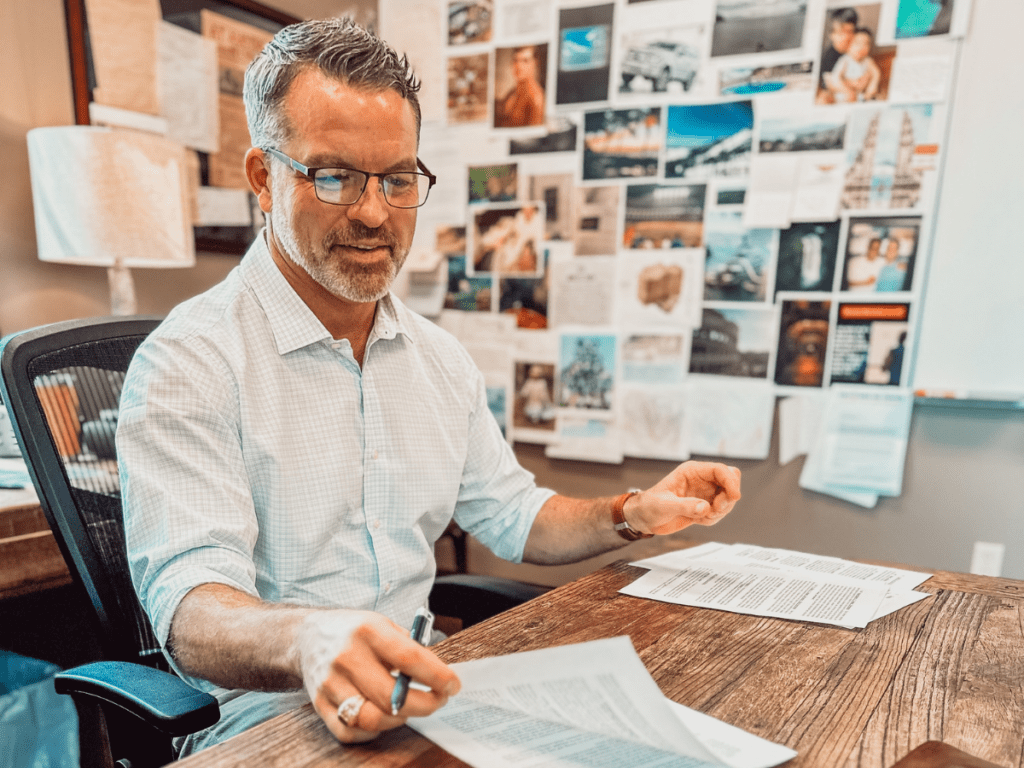

For many people, starting a business can seem like a daunting task. The steps can be intimidating, especially when you attempt the setup process alone. It’s easy to get discouraged or even stuck without proper guidance and support when regulatory obstacles arise. Your attorney can avoid making the two most common legal mistakes new business owners make.

First, establish your entity.

The excitement of starting your own business may lead you to throw caution to the wind. Afterall, you have a business plan to make it a reality. You can’t wait to get started. We hear this from our clients almost every day. While their enthusiasm to get to work is critical for their startup’s success, they often risk their dream by operating without establishing their business’ legal entity. This costly mistake can lead to many problems down the road.

Before opening your doors for business, create a distinct legal entity through the state, such as a corporation or limited liability company (LLC). Individuals operating a business without a distinct legal entity are operating as a sole proprietorship. Sole proprietorships are not a separate entity. The operators have no “liability shield.” This means that any of the business’ liabilities and obligations fall to the owner personally in the event of a lawsuit or debt collection. In this situation, anyone who sues you for the actions of the business can seize your personal assets such as your home, bank and investment accounts, and other property. Thus, having a distinct legal entity is absolutely critical to protecting your assets.

Next, create your internal documents.

Unfortunately, operating a business requires more than being the best in your field, especially when you start expanding. After you establish your entity, the next order of business is to draft your internal documents, which includes an operating agreement and your corporate bylaws. Your internal documents, also known as “controlling documents,” define and govern almost all activities of the business. They do not necessarily dictate “how” you do things, but rather, who has the authority to do things on behalf of the company, including what actions can be taken in a contingency, such as a merger or sale of an owner’s stake in the company.

Your internal documents can also help you obtain financing. Banks are cautious when extending credit to an organization. Your internal documents offer clarity and protection to the interests of its owners. With your internal documents in place, you will be ready to make decisions and move forward when new opportunities for your business arise.

Tressler is a team you can trust.

At Tressler, we aim to help you achieve their goals and be a team you can trust. We understand how much work goes into building your business and how important it is to have support and guidance along the way. Our team can help you establish your business legal entity and create your internal documents so you can prevent risks and make the best decisions for your future. Contact our team today!